Tax Credits For Efficiency Upgrades

Home improvements can be expensive, but tax incentives are helpful for those who want to make changes that will contribute to more efficient energy management in the home. The Consolidated Appropriations Act has been extended through the end of 2016, providing homeowners with an incentive for making eligible improvements. This legislation provides the homeowner with an opportunity to save up to 10 percent of the costs for updating the envelope of their home, including revamping the insulation or updating roofing materials. It is important to note that eligibility requires that a Toms River roofing project be completed prior to the end of the year.

Some homeowners can handle their own insulation upgrades. However, a roofing professional could be helpful for someone who has limited time for DIY projects. Those who are not comfortable with working in the attic might also benefit from professional assistance. Further, a roofing contractor can ensure that the appropriate materials are selected based on area weather trends and the home’s structure. It is important to realize that the tax credits do not cover labor costs.

A cool roofing project could be extremely challenging for a homeowner to complete on their own.

Not all roofing materials qualify, which means that it is important to select products that are certified by ENERGY STAR. Asphalt roofs that are created with cooling granules qualify for the tax credit. Pigmented metal roofs are also eligible. Because there is potential to damage one’s roof while removing old coverings or while installing new coverings, there is potential for future leaks if this is handled by an amateur. Although labor costs are not eligible for reimbursement through the tax credit, DIY labor could create huge repair costs in the future.

Because a cool roof reduces the temperature of the roof as it minimizes heat gain, the savings in the future can be far greater than just a tax credit. The temperature of a cool roof during summer can be 50 degrees cooler than a roof that lacks efficiency features, which can dramatically lower the amount of energy needed to keep a home cool during the summer for many years to come. Meanwhile, other envelope improvements can help a homeowner to reduce heating and cooling energy demands by as much as 10 percent each year. It is important to evaluate one’s personal tax situation prior to moving forward with a roofing or envelope upgrade if the tax credit is the main goal in implementing such a project. The roofing experts at Fortified Roofing of Toms River NJ can answer your questions about gutters or roof repairs.

Common roofing term explained by Fortified Roofing of Toms River NJ:

Heat gain

A home’s temperature can be affected by outside conditions, and when a cool home absorbs heat from the outside environment, the activity is referred to as heat gain. When heat gain occurs quickly during the summer, an air conditioning system tends to go through more frequent cycles, which also causes energy usage to increase.

Toms River FAQ about roofing:

When should more insulation be added to the attic?

Attic insulation can be affected by structural problems such as leaks. Water damage can lead to mold growth, which may affect not only the performance of the material but also the indoor air quality of the home. In such a case, old insulation may need to be removed and replaced. If there is not any damage, the ability to see the floor joists suggests that supplemental insulation is warranted.

View All Articles

Ask A Question

If you would like to ask a question regarding roofers, a new roof installation, roof leak repairs, skylight options or gutters and downspouts please contact Fortified Roofing today!

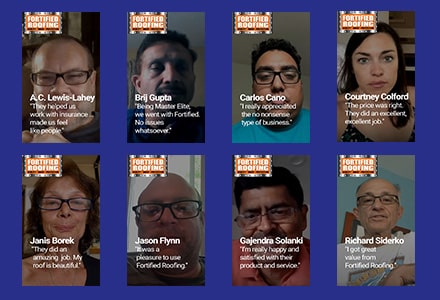

Rated 4.7 out of 5 stars based on 8 customer reviews.

Oh My! People say such nice things!